Trickle-down economics is an economic theory based on the principle of providing tax relief and economic incentives to the rich and corporations, which will eventually lead to economic growth. It claims that the tax cuts and policies employed by the government, would encourage investment, acting as a motivating force for the corporations that eventually would act as an incentive for rising demands and spending money and at the end propelling the economy. It was a key element of President Ronald Reagan‘s economic policies of the 1980s, known as Reaganomics.

According to the policy makers and its advocates, the trickle-down policy is supposed to benefit every member of the society in the long run, while privileging the rich with the instant profit. But the reality is that it never truly helps reduce income inequality and would never stop the widening gap between the rich and the poor. And if it does, its effects are not tangible among the poorer majority.

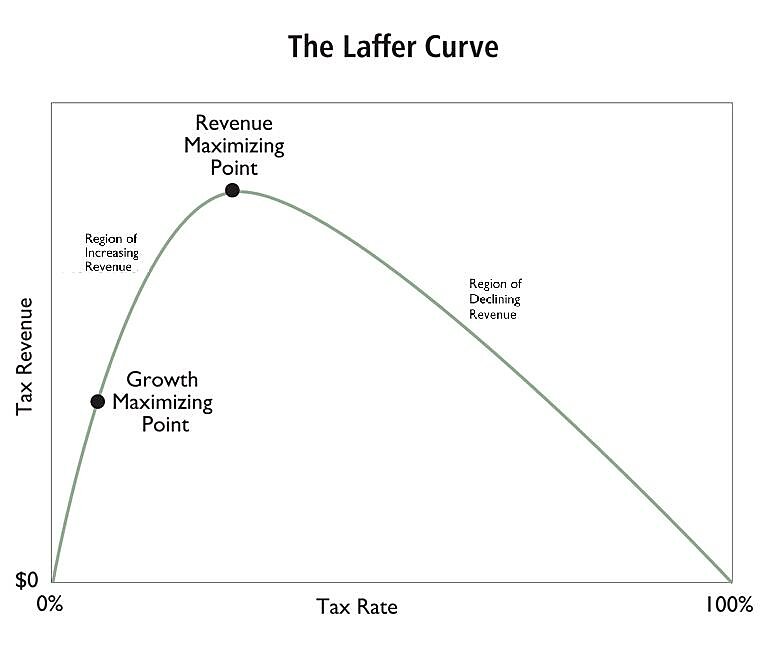

The idea is that by cutting taxes and reducing the capital gains tax, the companies and rich people would have more money and they will invest in production, create more jobs and sustain the economic growth. The Laffer Curve, which was formulated by the economist Arthur Laffer, is one of the most popular arguments in support of trickle-down economics.

The Laffer Curve demonstrates the theory that there exists an optimum rate of taxation that will generate the maximum amount of revenue for the government without discouraging productivity and investment. Based on this theory, when tax rates become too high, people work less and invest less, and as a result, there is minimal tax revenue collection.

HOW IT AFFECTS THE REAL WORLD

The Reagan administration implemented those principles in the Economic Recovery Tax Act of 1981. It began making drastic reductions in taxation, lowering the top marginal income tax rate from 70% to 50% and introducing a multitude of tax incentives for businesses. There are some advocates who believe that Reagan‘s policies resulted in strong economic growth in the 1980s.

Critics, however, think that the benefits of Reagan’s tax cuts were not evenly distributed. They contend that while the economy did grow, the majority of the wealth created during this period was in the hands of the top earners and not trickled down to the middle and lower classes. To critics, salaries for the typical worker increased rather slowly throughout the 1980s while income inequality increased enormously.

The richest Americans saw their incomes rise considerably, but certain middle- and lower-income families did not see their economic position rise to the same degree. Besides, reducing the tax would cut the governments revenues that would manifest itself in other parts.

Aside from the Reagan era, trickle-down economics has been a part of American economic policy. For instance, President George W. Bush lowered taxes in the early 2000s by reducing the highest marginal income tax rate and cutting taxes on capital gains. Similarly, President Donald Trump‘s Tax Cuts and Jobs Act of 2017 reduced business tax rates significantly and reduced taxes on wealthy individuals significantly. None of these initiatives led to the pay increase of the middle and lower-class Americans.

ENRICHING THE WEALTHY OR INCREASING THE MINIMUM WAGE

The fact is the trickle-down economics has not provided the economic gains it promised. Instead of enriching the society by allowing the wealth to trickle down, critics contend that the wealthy use tax shelters to become wealthier instead of investing funds in wage increases or employment. It has been proven through research that tax cuts at the upper levels of society will result in higher saving rates among the elite rather than investment in new business or consumption.

The more important propeller of economic growth, according to the critics is spending more on public services and goods, i.e., public works, education, and medical care. They believe that it would be much more beneficial if instead of enriching the wealthy, it would be better to strengthen the middle and lower classes by increasing the minimum wage and expanding social programs. If the workers are paid more, they have more to spend, which stimulates demand and economic growth from the bottom up rather than waiting for the wealth to trickle down from the top.

"*" indicates required fields

References:

Stubbs, Ian. “Reaganomics Trickled Down to Basics.” Georgetown.edu, 2024.

Kenton, Will. “Trickle-Down Economics: Theory, Policies, and Critique.” Investopedia, 2024.

Sowell, Thomas. Trickle Down Theory and Tax Cuts for the Rich. Hoover Institution Press, 2012.